Financial Risk Management Software Market Size By Types( On-Premise, Cloud ), By Application( Small Business, Midsize Enterprise, Large Enterprise, Other ), Industry Trends,Share and Forecast 2023 - 2030

Market Overview

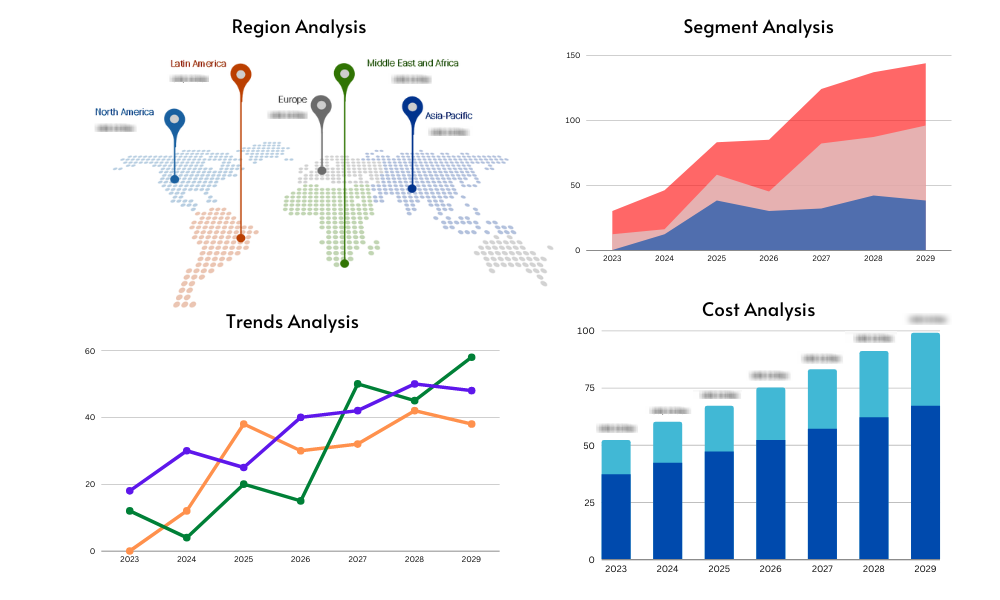

The global Financial Risk Management Software Market size was valued $ 1849 million in 2022 and is expected to reach $ 3295 million by 2030, growing at a CAGR of 8.6% from 2023 to 2030.

The Global Financial Risk Management Software market is anticipated to rise at a considerable rate during the forecast period, between 2023 To 2030. In 2022, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

The extensive documentation of the Financial Risk Management Software industry gives access to all the factors expected to influence the growth prospect of the business worldwide. Nobel effort to capture the factors that impede the growth of the market is clearly visible in the report. These factors result in an effective and reliable branding and promotion and marketing plan. In addition, comprehensive coverage of recent advancements, product nearing development stage, project pipeline, and major industrial players offer all the confidence a business owner needs to design a business strategy that will drive company\'s success.

Understanding what the audience is looking for in a report the researchers behind this attunes deliverables according to their needs such as product price, demand and supply status, end-use, profit and others. By operating in close alignment with the major vendors, the researchers have customized the literature – based on universal perspective as well as comprehensive knowledge of the local business owners. The document further aims at addressing the different challenges and opportunities of carrying out business operations in North America and beyond.

| Report Attributes | Report Details |

| Base Year | 2022 |

| Forecast year | 2023-2030 |

| Unit | Value (USD Million/Billion) |

| Segments Covered | Key Players, Types, Applications, End-Users, and more |

| Major Players | IBM, Oracle, SAP, SAS, Experian, Misys, Fiserv, Kyriba, Active Risk, Pegasystems, TFG Systems, Palisade Corporation, Resolver, Optial, Riskturn, Xactium, Zoot Origination, Riskdata, Imagine Software, GDS Link, CreditPoint Software |

| Industry Coverage | Total Revenue Forecast, Company Ranking and Market Share, Regional Competitive Landscape, Growth Factors, New Trends, Business Strategies, and more |

| Report Coverage |

|

| Report Highlights |

|

| Region Analysis | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Tables, Figures, and Charts | 279 |

The industry experts have left no stone unturned to identify the major factors influencing the development rate of the Financial Risk Management Software industry including various opportunities and gaps. A thorough analysis of the micro markets with regards to the growth trends in each category makes the overall study interesting. When studying the micro markets the researchers also dig deep into their future prospect and contribution to the Financial Risk Management Software industry.

A high focus is maintained on factors such as demand and supply, production capacity, supply chain management, distribution channel, product application and performance across different countries. The report not only offers hard to find facts about the trends and innovation driving the current and future of Financial Risk Management Software business, but also provides insights into competitive development such as acquisition and mergers, joint ventures, product launches and technology advancements.

Market Segmentation

The Financial Risk Management Software market is segmented on the basis of Types, Applications, Key Companies, Regions & Countries.

Market by Type

On-Premise

Cloud

Market by Application

Small Business

Midsize Enterprise

Large Enterprise

Other

Market By Region

Asia-Pacific [China, Southeast Asia, India, Japan, Korea, Western Asia]

Europe [Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland]

North America [United States, Canada, Mexico]

Middle East & Africa [GCC, North Africa, South Africa]

South America [Brazil, Argentina, Columbia, Chile, Peru]

Key Players

The Global Financial Risk Management Software Market study report will provide valuable insight with an emphasis on the global market including some of the major players such as

IBM

Oracle

SAP

SAS

Experian

Misys

Fiserv

Kyriba

Active Risk

Pegasystems

TFG Systems

Palisade Corporation

Resolver

Optial

Riskturn

Xactium

Zoot Origination

Riskdata

Imagine Software

GDS Link

CreditPoint Software

A quick look at the industry trends and opportunities

The researchers find out why sales of Financial Risk Management Software are projected to surge in the coming years. The study covers the trends that will strongly favour the industry during the forecast period, 2023 to 2030. Besides this, the study uncovers important facts associated with lucrative growth and opportunities that lie ahead for the Financial Risk Management Software industry.

Our market analysis also entails a section solely dedicated to such major players wherein our analysts provide an insight into the financial statements of all the major players, along with product benchmarking and SWOT analysis. The competitive landscape section also includes key development strategies, market share, and market ranking analysis of the above-mentioned players globally.

Customization of the Report

Our research analysts will help you to get customized details for your report, which can be modified in terms of a specific region, application or any statistical details. In addition, we are always willing to comply with the study, which triangulated with your own data to make the market research more comprehensive in your perspective.

This Financial Risk Management Software market report holds answers to some important questions like:

• What is the size of occupied by the prominent leaders for the forecast period, 2023 to 2030? What will be the share and the growth rate of the Financial Risk Management Software market during the forecast period?

• What are the future prospects for the Financial Risk Management Software industry in the coming years?

• Which trends are likely to contribute to the development rate of the industry during the forecast period, 2023 to 2030?

• What are the future prospects of the Financial Risk Management Software industry for the forecast period, 2023 to 2030?

• Which countries are expected to grow at the fastest rate?

• Which factors have attributed to an increased sale worldwide?

• What is the present status of competitive development?

Research Methodology

The Market Reports Insights offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Reports Insights assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Reports Insights provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.